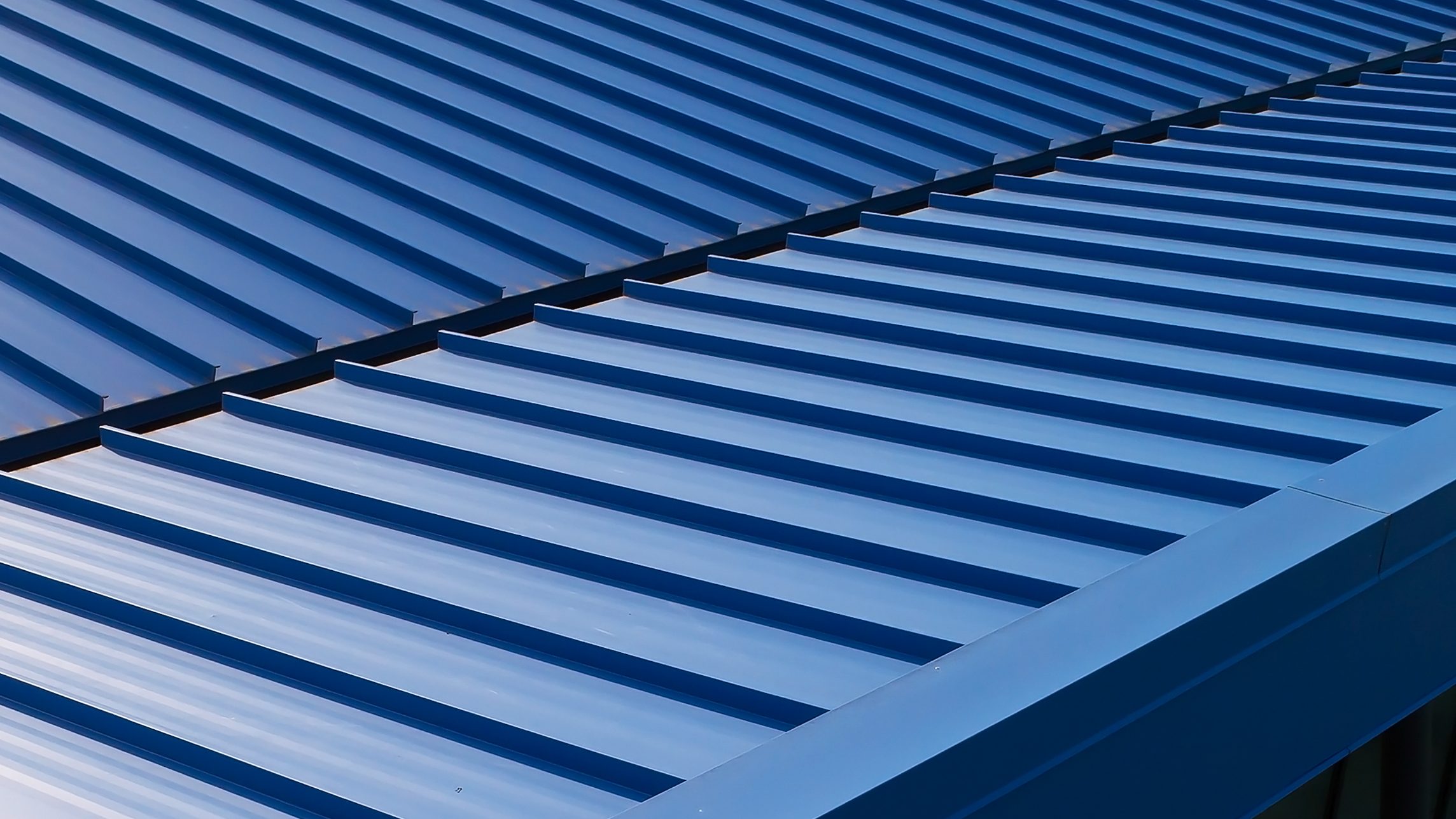

PAC-CLAD metal wall and roof panel systems are sustainable due to their exceptional longevity, energy efficiency and recyclability. With a lifespan of 50 years or more, metal roofs reduce the need for frequent replacements, conserving resources. Their reflective properties keep buildings cooler, lowering energy consumption and costs. Additionally, most of PAC-CLAD’s metal siding and roofing systems are made from recycled metals and are fully recyclable at the end of their life cycle, minimizing waste and contributing to a greener future.

Additional Resources

70% Polyvinylidene Fluoride (PVDF)

PVDF coatings on PAC-CLAD products contain resins that provide resistance against harmful ultraviolet radiation. Buildings that are clad with PVDF-coated products can reduce their carbon footprints by reflecting the sun’s energy to keep interiors cool during warm weather. Information relating to these and other sustainable features of PAC-CLAD steel and aluminum wall and roof panels is available on this page.

What Makes Metal Wall and Roofing Products Sustainable?

Reduce Cooling Costs

PAC-CLAD solar reflective coatings — industry-leading in reflectivity — combat urban heat island effects and boost energy efficiency. They reflect sunlight, reducing heating and cooling costs by up to 40%. Combined with metal’s durability and recyclability, they enhance the sustainability of any project.

Ease of Installation

Solar panels attach with clips on standing seam metal roofs and require no drilling which preserves roof integrity. Their sleek design complements the roof’s modern aesthetic. Reflective metal roofs can boost solar efficiency by reflecting more sunlight onto the solar panels.

Designed to Last

Metal roofs and siding have a longer lifespan compared to many other materials, such as asphalt shingles or wood. They can last 50 years or more with proper maintenance, reducing the need for frequent replacements and minimizing waste.

Heat and Sun Protection

Metal reflects heat from the sun, which can help reduce cooling costs in hot climates. It can also be coated with reflective coatings to enhance its energy efficiency.

100% Recyclable

Metal roofing and siding systems are highly recyclable materials. When they reach the end of their useful life, they can be recycled into new metal products, reducing the demand for virgin resources.